Economy set to pick up pace in 2024

China's economy is likely to pick up pace and grow steadily in 2024 after a bumpy recovery last year, propelled by the gradual increase in domestic demand and with more stimulus policies in the offing, officials and economists said on Wednesday.

As the broader economy is still facing pressures from a property downturn, lack of effective demand and risks associated with local government debts, economists said the country needs to set an annual GDP growth target of around 5 percent to boost business confidence, and the policy easing should focus on housing and fiscal measures.

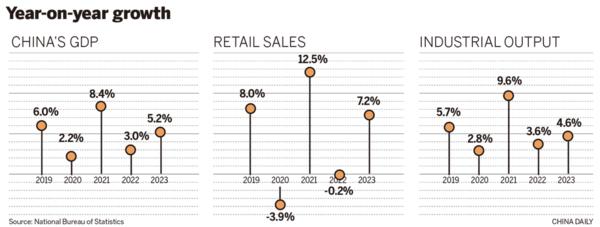

Data from the National Bureau of Statistics showed on Wednesday that China's GDP expanded by 5.2 percent year-on-year in 2023 to 126.06 trillion yuan ($17.63 trillion), surpassing the country's preset annual growth target of around 5 percent.

In the fourth quarter of 2023, the Chinese economy grew 5.2 percent year-on-year, following a 4.9 percent growth in the third quarter.

"China's 5.2 percent growth rate is higher than the anticipated global growth rate of around 3 percent, outpacing many major economies," Kang Yi, head of the National Bureau of Statistics, said at a news conference in Beijing on Wednesday. "China is projected to have contributed more than 30 percent of global economic growth in 2023, making it a primary engine driving global growth."

Despite the challenges and difficulties ahead, Kang said that China possesses many advantages and enjoys several opportunities, which outweigh the challenges.

He said that China's economy is bound to see a steady recovery and improvement in 2024, given the continuing recovery trend, the continuous deepening of reforms and ample policy scope.

Louise Loo, lead economist at British think tank Oxford Economics, said: "There's plenty to be positive about in China's year-end reported numbers. The cyclical trough is likely behind us."

She added that industrial production is likely to accelerate on improved capacity utilization, higher industrial profits, and forward-looking restocking needs.

Industrial production is already showing signs of improvement, with China's value-added industrial output growing by 6.8 percent last month after a 6.6 percent growth in November.

She said that keeping up with the current growth momentum will require an ongoing and coordinated stimulus effort over the next few quarters.

Zou Yunhan, deputy director of the macroeconomic research office at the State Information Center's Department of Economic Forecasting, said she expects the nation's economy to expand by around 5 percent in 2024.

"The momentum of China's economic recovery is poised to undergo further consolidation this year, propelled by robust policy support, the advancement of industrial transformation and upgrading, and the continuous deepening of reforms."

Meanwhile, due to the "scarring effect" of the COVID-19 pandemic over the past few years, it could still take time for people's spending power to recover, Zou said.

Retail sales, a key measurement of consumer spending, increased by 7.4 percent in December, down from the 10.1 percent growth a month earlier.

Yu Yongding, an academician at the Chinese Academy of Social Sciences, said the contributions of consumption and net exports to GDP growth will likely be lower compared with 2023, and capital formation will thus play a bigger role in maintaining a high growth rate this year.

"If the growth rate of consumption in 2024 is lower than that in 2023, achieving a 5 percent GDP growth may require double-digit growth in infrastructure investment," he said.

Yu said that China should set an annual growth target of at least 5 percent, and the focus should be on expanding budgeted fiscal deficit rates and increase in treasury bonds to provide funding for infrastructure investment.

NBS data showed that China's fixed-asset investment rose by 3 percent in 2023. Infrastructure investment and manufacturing investment grew by 5.9 percent and 6.5 percent, respectively, while real estate investment fell by 9.6 percent in 2023.

Tom Orlik, chief economist at Bloomberg Economics, said that China's policymakers have been doing the right thing by attempting to manage the problem of oversupply without triggering a complete collapse in the real estate sector. He said there will be enough stimulus, financing and support for homebuyers this year.

He said that China has the scope to keep monetary and fiscal policies supportive to help bolster the economy's recovery, adding that a forceful fiscal policy will play a bigger role in boosting domestic demand.

Zheng Houcheng, chief macroeconomist at Yingda Securities, said a further reduction in the reserve requirement ratio as well as policy rate cuts will likely happen in the first half of 2024.