'Made in China' goes for gold in Paris

The Ancient Olympic Games were made in Greece, but it seems the just-concluded Paris 2024 Olympic Games were "made" in China. This is not only because China is one of the top two gold medal winners, but also because a significant portion of the equipment used in the Paris Olympics originated from China.

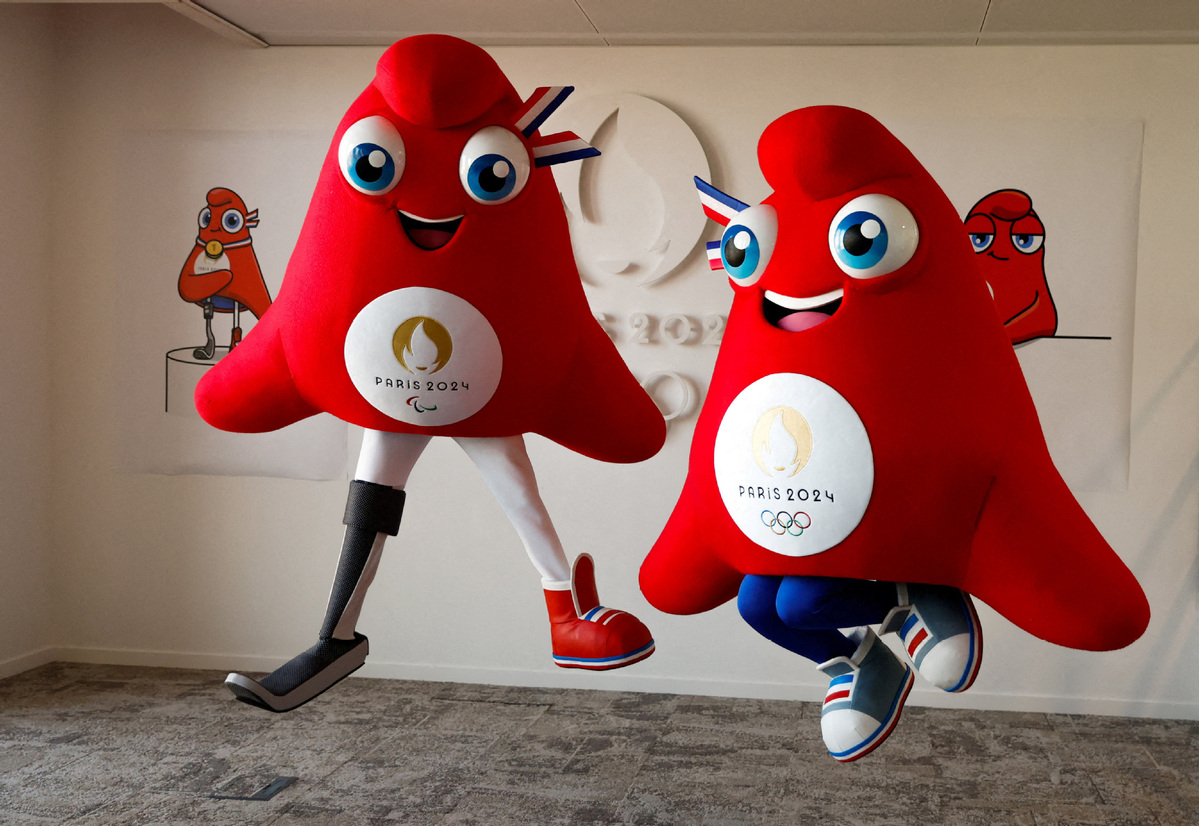

From table tennis balls and judo mats to Phryges doll mascots, silicon bracelets, LED displays and microchip-embedded footballs, China's contributions to the Games' equipment were extensive. While some of these products may seem basic and low-tech, items like table tennis balls require precise specifications that only China can achieve at a low per-unit cost.

The competitiveness of Chinese products attests to China's meteoric rise in intelligent manufacturing, also known as Industry 4.0. In 2011, at Hannover MESSE, German industrial leader Bosch argued that the future of industry lies in the widespread integration of information and communications technology in production. Chinese leaders immediately recognized the potential of this integration for China's labor-intensive and low value-added manufacturing.

Chinese strategists minutely studied Germany's 2012 "High-Tech Strategy 2020" and invited key German partners to engage in the joint development of Industry 4.0 in China. Jiang Zemin — then Chinese President — had foreseen in a prophetic 1998 academic article the disruptive potential of ICT on industry, describing its effect as a "converter" for methods of development, and a "booster" for upgrading industries. China consequently mobilized and invested aggressively in information and communication infrastructure. Being a world champion in 5G, which is a core pillar of smart manufacturing, China has made significant strides to become a smart manufacturing powerhouse.

Even as overall foreign direct investment (FDI) declines, investment in China's advanced manufacturing continues to rise. The economic data for the first five months of this year show that FDI inflows into smart consumer equipment manufacturing and professional technical services increased by 332.9 percent and 103.1 percent year-on-year respectively. The advancements in intelligent manufacturing are reshaping the Chinese economy and transforming its trade relationships with countries around the world.

Domestically, smart automation enables China to optimize its labor force amid a shrinking working-age population. This demographic challenge, often seen as a negative impact, could become a boon if leveraged correctly. With the productivity gains from intelligent manufacturing, per capita income could rise rapidly. If the Chinese government successfully redistributes these capital gains and invests in an improved welfare system (from hospitals to schools to universities), the overall effect on the country could be decidedly positive.

On the international front, China's Industry 4.0 prowess presents both opportunities and risks. High-quality yet affordable goods from China benefit consumers globally, making them a societal asset. With inflationary pressures in the European Union and the United States driven by high energy costs and the monetary overexpansion of the COVID-19 years, China's competitively priced products can enhance consumer surplus and help alleviate the high cost of living crisis.

However, the surge in Chinese exports to the EU and the resulting ballooning trade deficits present a significant challenge for Western leaders who need to prioritize domestic job creation. The EU, which once was a global leader in industries such as automobiles and green energy hardware, now faces China's unmatched competitiveness in these sectors. There is limited political space for maneuver.

There is no panacea to the challenges China faces in its trade relations with the EU and the US. However, while the US views Chinese exports through a geopolitical lens, the EU remains a more objective evaluator of its trade relations with China. This is where the resolution of the recent third plenary session of the 20th Central Committee of the Communist Party of China, which emphasizes the need to raise the share of household disposable income in GDP, could offer an interesting path forward.

Boosting disposable income in China would increase domestic consumption, absorbing part of China's production while also increasing imports due to the propensity of imports to generally increase as disposable incomes rise. Such a shift from investment to consumption will not be immediate or meteoric, but, over time, it could lead to a more balanced trade relationship with the EU, easing the political pressure on EU leaders.

Moreover, China's expertise in smart manufacturing gives the country a powerful tool to invest and create joint-greenfield projects in the EU — an approach likely to be welcomed by Europeans. When Europe enjoyed a clear advantage over China in industrial productivity, China required European companies to invest locally. By emulating this strategy, with Chinese industrial giants investing in Europe, China could help neutralize anti-China protectionist sentiments and create well-paid local jobs.

Unlike the Olympic Games, where referees set and enforce the rules of competition, international affairs lack an overarching authority to impose order. The World Trade Organization, once the arbiter of global trade disputes, now stands crippled as major states obstruct its function. China's progress in smart manufacturing is indisputable. However, its commercial relationship with the EU and the rest of the world will require smart adaptation to the realities of an increasingly protectionist global trade environment.