Two largest developing nations seeking common good

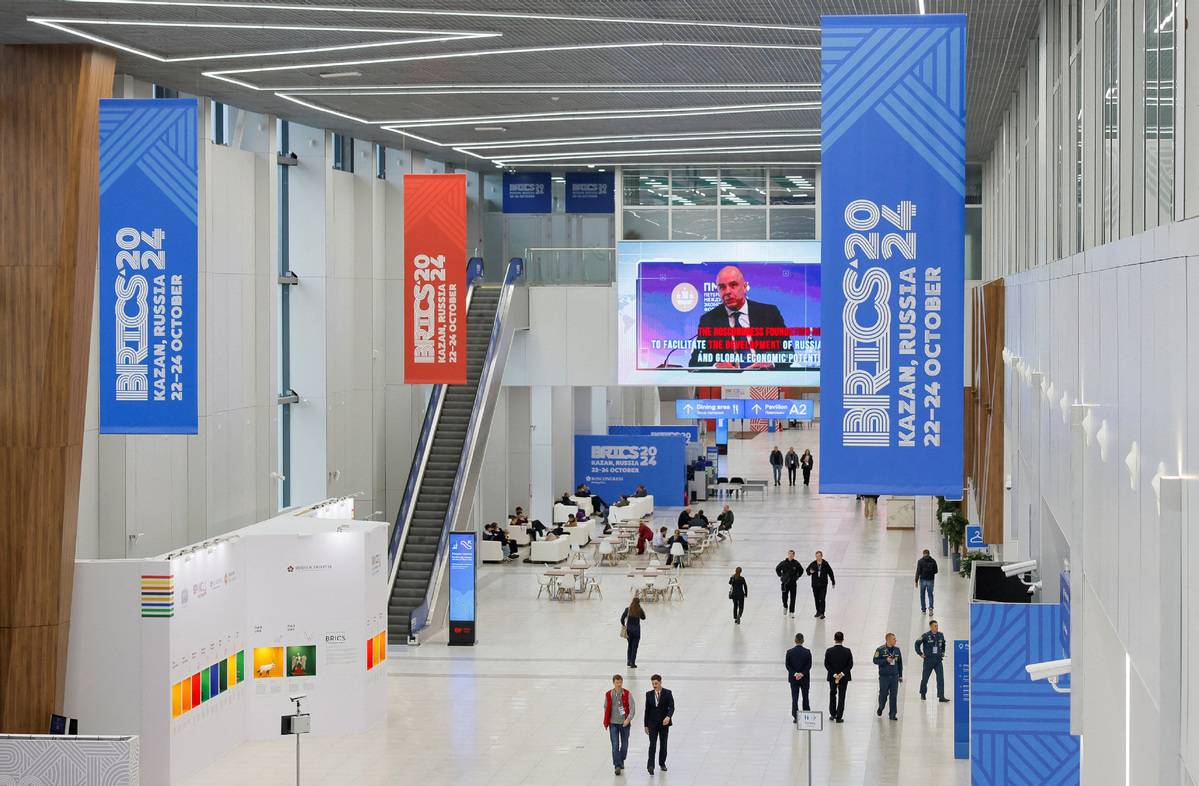

People walk at the venue of the BRICS summit in Kazan, Russia October 21, 2024. [Photo/Agencies]

With all the 10 BRICS member states (including five new members) meeting in Kazan, Russia, for the annual leaders' meeting from Tuesday to Thursday, the original five members of the grouping have catapulted onto varying trajectories that need urgent and innovative planning.

Other than their immediate priorities, the BRICS members must also address the deepening structural challenges that have emerged due to their ever-expanding agenda and asymmetries, and aspirant countries seeking to join, or at least align with, BRICS, so as to herald a new global financial order.

In the BRICS' ongoing tryst with global governance reform, it is important to understand how and why the onus lies primarily on Beijing and New Delhi.

To begin with, by the end of last year China's GDP had increased to about $18 trillion, which is higher than the cumulative GDP of the other nine BRICS member states. All other BRICS members have China as their largest trading partner and, except India and Brazil, all are part of China-proposed Belt and Road Initiative.

While for Brazil, China is the destination of nearly one-third of its global exports, for India, the imports from China exceed its imports from its next four largest trade partners combined. India, with nearly annual 7 percent economic growth and the world's largest youth population, seems set to become the world's third-largest economy by 2030, next only to the United States and China.

As the two leading growth engines of BRICS Plus, China and India have to shoulder the responsibility of steering BRICS' redemption as it begins to work with new members and co-opt several other partners from the list of more than 30 applicants to join the grouping.

Energy is BRICS' other advantage. As a driver of economic growth, this could make BRICS Plus the game changer and give China and India added leverage. With Iran, Saudi Arabia and the United Arab Emirates joining Russia in BRICS, the group accounts for about 40 percent of global oil exports. Incidentally, China and India happen to be the world's largest and third-largest oil-importing countries.

Also, BRICS' ongoing campaign to improve the global payment system has resulted in a noticeable increase in intra-BRICS trading in local currencies.

Collectively, the GDP of the BRICS members now accounts for more than 37 percent of the global total and is higher than that of the G7 countries. And yet the G7 countries continue to control leading global financial institutions such as the World Bank and the International Monetary Fund. Though the G7 member states are aware of BRICS' expanding economic heft — with China being as world's largest lender nation since 2017 — they remain frustratingly piecemeal in addressing these problems.

China and India have reached a plan to resolve the Sino-Indian border issue.

Besides, the Russia-India-China coordination will facilitate building consensuses at the BRICS Summit which, in turn, can help India and China slowly revive their pre-2020 bonhomie when the leaders of the two countries also held "informal summits".

In his first five years in office, the Indian prime minister met with the Chinese leader more than a dozen times and visited China five times — more than the cumulative visits of all the preceding Indian prime ministers. And the recent high-level meetings and positive language from both sides raise hopes that India-China ties will return to normal.